People who make a lot of money often think that they will be wealthy because of their income.. The truth is, many of these high earners live paycheck to paycheck. They have salaries but they still struggle. They are stuck in a cycle of spending too much money and owing too much debt. These people, the earners have to be careful, with their money because having a big salary does not mean they will have a lot of wealth. The high earners need to change the way they handle their money.(Common Money Traps)

1. Lifestyle Inflation Traps

When you get a raise and start earning money you will probably want to spend more money on things like luxury cars or fancy clothes. This is because you want to show people that you have a lot of money like your neighbors the Joneses. The problem with this way of thinking is that it stops you from saving your money from the first day you get a raise. Earning money should help you save more but if you keep spending it on status symbols, like luxury cars or designer clothes you will not have any money left to save.

When people get a raise they often spend money on their homes, vacations and eating out. This is because they have money to spend. If people do not make a budget on purpose they will probably spend about 70 percent of their money on things they do not really need within a few months. People tend to spend more on things, like homes, vacations and dining out as their income grows.

You should keep an eye on what you are spending money on after you get a promotion. This way you can use the money to buy things that will be worth more later, like assets. Track your expenses so you can redirect your money toward assets instead.

2.Debt Accumulation Cycles

Having a salary is great because it means you can get a bigger loan to buy a house or a car or pay for school.. The problem is that if the interest rate is high it makes it really hard to pay back the loan. When you only make the payment every month you are going to be paying off the loan for a very long time, like twenty or thirty years. This is bad because it means you are not using that money to build up your wealth, which is what you really want to do with your money like saving to buy a bigger house or retiring someday. Good salaries are supposed to help you with loans for homes and cars and education. High interest, on these loans can be a big problem.

Credit card debt is really high at 20 percent APR. This is more than the money people are making from their jobs. For people who work student loans and mortgages take up a big part of the money they bring home usually around 40 to 50 percent. This is a lot of money for credit card debt and other loans, like student loans and mortgages.

Prioritize high-interest debt payoff using snowball or avalanche methods before investing elsewhere.

3.Lack of Financial Education

Schools do not teach people about managing money. So professionals have to figure it out on their own by trying things and making mistakes. A lot of people do not understand things like compound interest and taxes and investing. This means they make choices, about money management and investing and taxes and compound interest.

People think that saving money means they have to give up things they want.. Really saving is about being free to do what you want later on. The thing is, a lot of people do not know about things, like index funds or Roth IRAs. So they just leave their money in accounts that do not pay interest, like 0.01%. This means their money is not growing like it could be. Saving with index funds or Roth IRAs can be a way to make your money grow over time.

Seek books like “The Millionaire Next Door” or free online courses to build foundational habits early.

4.No Emergency Fund Safety Net

Things do not always go as planned. Sometimes people get sick. They have to pay a lot of money for medical bills.. They might lose their job. When this happens people often have to use credit cards with high interest rates. The problem is that if people do not have money saved up it does not matter how much they usually earn. If they do not have 3 to 6 months of expenses saved their good salaries do not help them during times, like medical bills or job loss.

Living without a safety net, like this means you have to use the money you saved for the future, which’s a big problem. You will have to pay penalties. You will not get the money you could have gotten if you just left it alone.. To make things worse inflation keeps going up so the money you do have will not be worth as much as it used to be. This really hurts if you do not have a lot of cash set aside because inflation just keeps eating away at what you have. Living without this buffer is really tough because you have to dip into your investments or retirement accounts and that is not what you saved that money for.

Automate transfers to high-yield savings immediately after payday to enforce discipline.

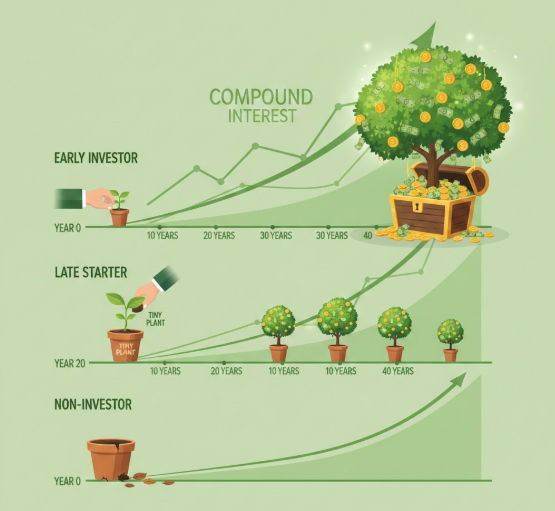

5.Failing to Invest Early

Money builds up over time. Putting things off slows down how fast it grows. If you invest $10,000 every year and get a 7% return wealth will grow to $1.6 million in 40 years.. If you only do it for 20 years your wealth will only be $230,000. This is because wealth compounds over time. The time you give your wealth to grow the more it will increase. So if you start investing $10,000 every year at a 7% return your wealth will be much bigger in 40 years than it would be, in 20 years.

People who invest often wait for the moment to put their money in but they end up missing out on big gains because of that.

Investing a money at a time in cheap exchange traded funds or ETFs for short helps to reduce the ups and downs of the market.

This way investors can avoid making mistakes because of fears, about what the market will do.

Investing in low-cost ETFs is an idea because it helps to make the market less scary.

People should just invest in ETFs of waiting for the perfect timing, which is really hard to figure out.

Investing in low-cost exchange traded funds or ETFs is a way to make money without losing too much when the market goes down.

When you get a job start by taking advantage of the employer 401(k) matches. This is basically money that your employer gives you. The great thing about employer 401(k) matches is that they can really make a difference right away. The money you get from your employer 401(k) matches can double the impact of the money you put in. That is a really good thing. So taking advantage of employer 401(k) matches is a move because it is, like getting free money that helps your employer 401(k) grow faster.

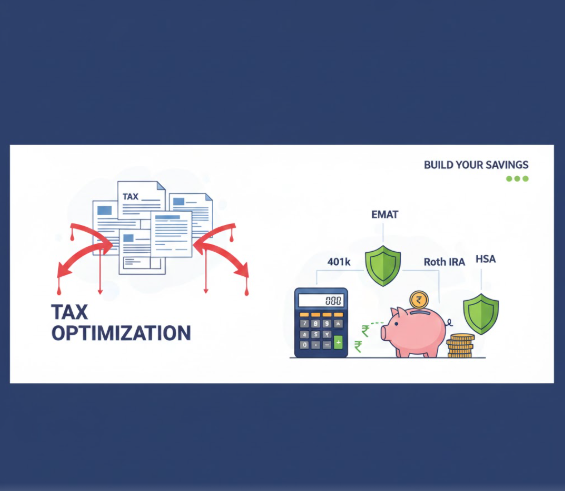

6.Tax Inefficiency Oversights

People who get a salary often do not notice the things that can reduce the amount of taxes they have to pay, such as the money taken out of their paycheck and the special accounts for retirement.

When people with a salary do not put money into accounts like Health Savings Accounts or college savings plans they end up paying more taxes than they need to and that can add up to a lot of money over the course of a year it is, like throwing away thousands of dollars every year.

People who work for themselves like those with home offices like the benefits that come with it but people who get a W-2 form often do not realize how good it is to put as much money as they can into accounts that are taxed later. When people plan ahead they can lower the amount of taxes they pay by 10 to 20 percent. This is because planning helps people make the most of their money and pay less in taxes, which’s a big deal, for people who get a W-2 form and want to keep more of their money.

Consult tax software or advisors annually to optimize filings and harvest losses.

The consumerism mindset is really in charge these days. It is, about buying things. People are always looking to get the stuff. The consumerism mindset is everywhere. It affects the way people think about things like what they want and what they need. The consumerism mindset is very powerful. It is driving people to buy more things.

People think it is better to buy things than to make things. Advertisements tell people who have a lot of money that they should get things because they work hard. This makes people think that if they save their money they are missing out on things. Society likes it when people buy things not when they save their money or make things themselves. People who make a lot of money are told they deserve luxuries, like cars or big houses after they work hard.

We make a lot of buys using those one-click apps. These impulse buys add up. We end up wasting, over five thousand dollars every year. Social media makes things worse. It makes us feel like we are missing out on things so we buy things just because they are trendy. We forget about what’s really important and what will last forever. One-click apps and social media make us focus on what’s popular now instead of what is really valuable. Impulse buys via one-click apps are a problem. They cause us to waste a lot of money over five thousand dollars every year.

Adopt minimalism: buy quality over quantity, delay purchases 30 days, and audit subscriptions quarterly.

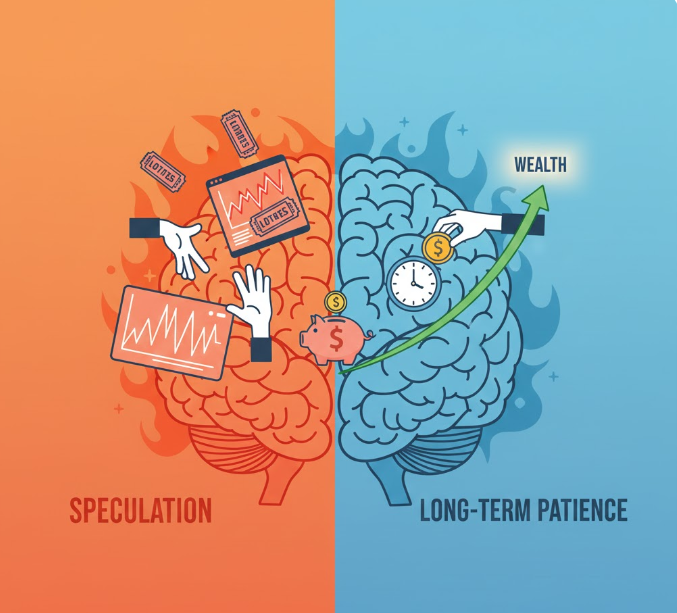

7.Short-Term Thinking Prevails

People who are chasing wins like lotteries or meme stocks are ignoring the things that really work.

A salary gives you stability. If you do not use it to buy things that will be worth something later you will just use it to buy things that make you happy for a little while.

This means that your money will be gone soon and you will not have anything to show for it.

Investing in things like assets is a way to make sure you have money in the long run because a salary is not enough, on its own to make you secure.

So people should think about what they want to achieve with their money and make a plan to get there of just trying to make a quick buck with lotteries or meme stocks.

People do not like to lose money so they keep their money in cash when the market is getting better. If you have a mix of investments and you wait for a long time you can get a return of 7 to 10 percent every year on average which is what happened in the past with diversified portfolios. Behavioral finance is what tells us that loss aversion is a part of this and that is why people should be patient, with their diversified portfolios.

Set 10-year goals and review portfolios yearly, not daily, to stay the course.

8.Comparison to Comparison Table

Factor Common Pitfall Wealth Builder Strategy

When I get an income raise I will spend one hundred percent of it on things that make my life better like a car or a nice vacation. At the time I will save and invest fifty percent of my income raise right away so I can have some money for the future. This way I can enjoy my income raise now. Also have some money saved for later. Income raises are an opportunity to do this so I will make sure to save and invest fifty percent of my income raises immediately and spend the rest on lifestyle upgrades.

Debt Management Minimum payments on high-interest loans Aggressive payoff, no new debt

Investing Start Wait for “right time” Automate monthly contributions

Emergency Fund Rely on credit cards 6 months expenses in liquid savings

Tax Planning File without optimization Max retirement accounts, harvest losses

This table shows us the moments when our habits start to go in different directions. The table really brings out the pivot points where our habits diverge. That is what makes it so useful, for understanding habits, especially the pivot points.

High salaries offer a launchpad, but discipline turns potential into wealth. Most fail by treating income as spending power rather than seed capital. Shift focus to assets generating returns, embrace delayed gratification, and educate continuously. True wealth emerges from consistent, boring actions over flashy displays. (Word count: 1028)