The global investing setup for 2026 looks less like a single “risk-on” or “risk-off” trade and more like a year of selective opportunities, where fundamentals and cash-flow resilience matter again. Many major outlooks point to easing financial conditions and rate-cut cycles in various countries, but also emphasize that inflation risks haven’t completely disappeared—conditions that tend to reward diversification across regions and across types of return drivers (growth, income, real assets).

At the macro level, global growth expectations remain moderate rather than booming, with the IMF projecting around low-3% world growth in 2026 in its recent forecasts. That’s an important backdrop: when growth is steady-but-not-explosive, the best opportunities often come from structural themes (technology diffusion, infrastructure buildouts, energy systems, and defense/industrial investment) rather than pure GDP acceleration.

1) AI buildout beyond “AI stocks”

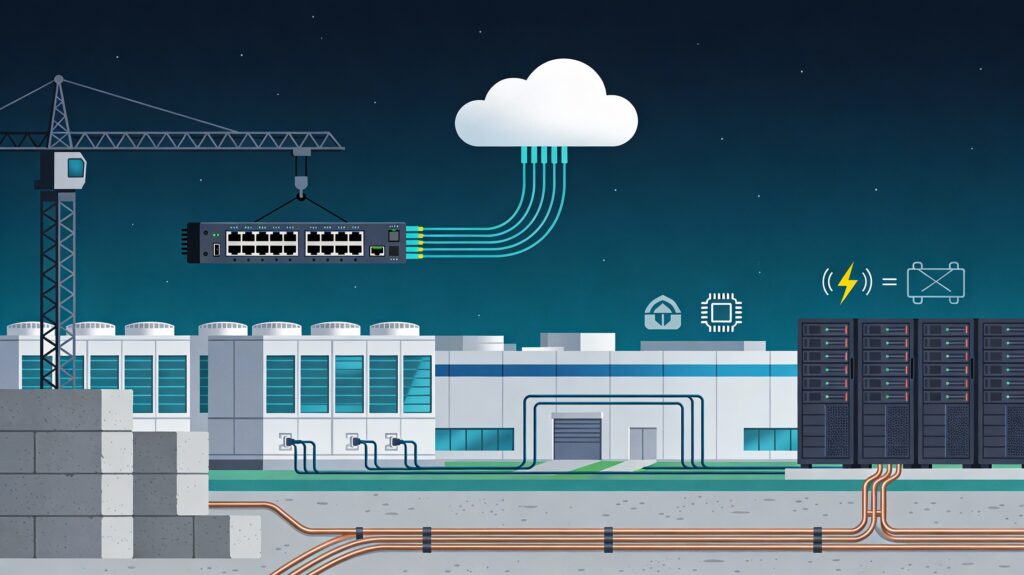

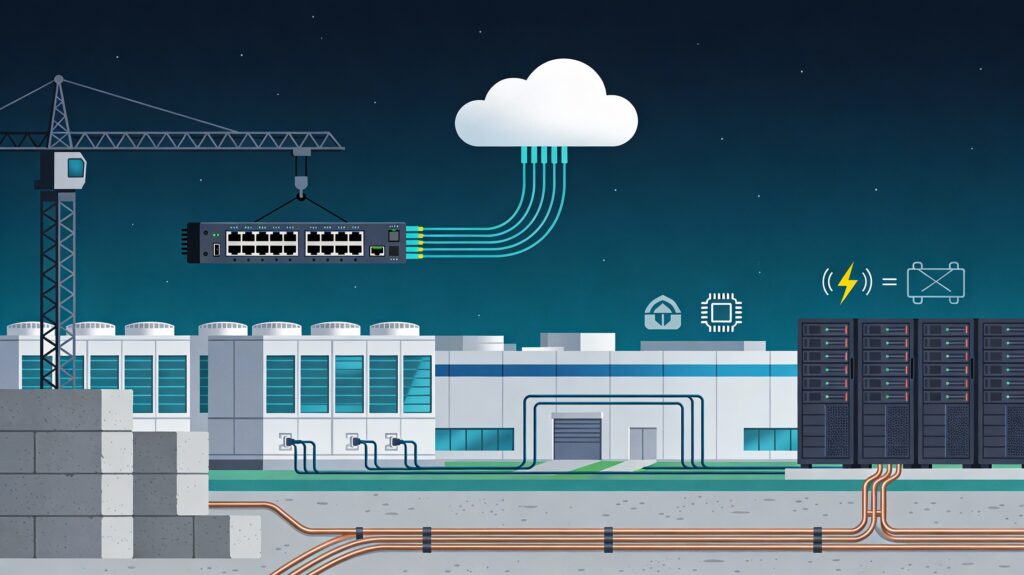

A common mistake is to treat “AI investing” as a synonym for a handful of mega-cap software or chip names. In 2026, the more durable opportunity set may sit in the picks-and-shovels economy around AI: data centers, networking, cloud infrastructure, and the physical buildout that makes model training and inference possible at scale. This is one reason many strategists keep highlighting capital expenditure as a key driver going forward—AI isn’t only code; it’s concrete, copper, cooling, and power contracts.

One practical way to express this theme is to look at global listed infrastructure and utilities exposed to grid upgrades and reliability investment, especially where regulated returns or long-term contracts can smooth earnings. Another angle is to watch companies enabling energy efficiency and load management, because the constraint in the AI race increasingly looks like electricity availability and grid throughput, not just algorithms.

2) Power, grids, and “electrification bottlenecks”

If AI is a demand shock for power, the broader energy transition is a multi-decade reshaping of generation, transmission, and end-use electrification. A number of 2026 outlooks explicitly connect AI-driven electricity needs with renewed investment in utilities, gas infrastructure, and grid modernization. This creates a global opportunity set that goes well beyond one country: grid capex cycles, interconnectors, storage, and efficiency upgrades are happening across developed markets, while emerging markets have the added driver of rising baseline power consumption.

Investors often debate “renewables vs. hydrocarbons,” but the more investable idea for 2026 may be system resilience: firms that build, maintain, and finance networks that can handle higher loads and more variable supply. Where policy supports network investment and regulation allows cost recovery, cash flows can be steadier than many people assume for an “energy” theme.

3) Quality fixed income as rates evolve

After years when bonds struggled, many 2026 outlooks argue fixed income can again be a meaningful return contributor—though with a wide range of outcomes depending on growth, inflation, and supply dynamics. Some strategists expect the yield curve to keep steepening as short rates come down faster than longer-dated yields, especially if inflation remains above target and fiscal supply stays heavy. That mix can create opportunity in active duration positioning, high-quality credit selection, and global bond diversification (not just U.S. exposure).

In practical terms, 2026 can be a year when “getting paid to wait” matters: laddered high-quality bonds, selective credit, and opportunistic allocations to segments offering strong carry may help balance equity risk. For investors building global portfolios, it’s also worth tracking how different central banks move at different speeds, which can open relative-value trades across countries rather than a one-direction bet on global rates.

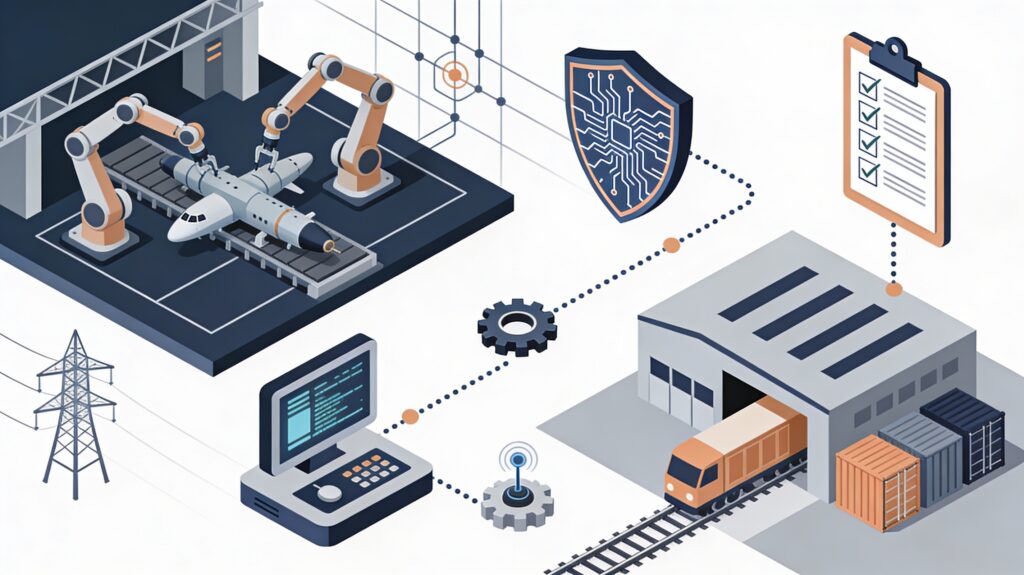

4) Defense, industrial capacity, and supply-chain rewiring

Another 2026 opportunity set sits in real-economy investment: defense spending, industrial reshoring, and supply-chain resilience. Some major multi-theme outlooks for 2026 explicitly include defense names and industrial beneficiaries of higher investment spending. The key nuance is that this theme can show up in several layers: prime contractors, specialized component suppliers, cybersecurity, and the industrial tooling needed to expand capacity.

This can also intersect with infrastructure and power: as more production and computing capacity is localized, demand rises for industrial sites, grid connections, and logistics. Instead of trying to guess geopolitics day-to-day, a cleaner way to approach this theme is to focus on companies with visibility into multi-year order books and those positioned in “must-have” national priorities.

5) Geographic diversification as a source of returns

For much of the past decade, many portfolios became U.S.-heavy by default—partly because U.S. tech led and partly because the dollar was strong. But several 2026 outlook discussions highlight the case for higher international allocations and the possibility that currency trends could become less of a one-way tailwind for U.S.-only investors. Separately, some strategists argue Europe and the UK may offer value opportunities if rate dynamics and fiscal stability improve, even while acknowledging competitiveness pressures for exporters.

This doesn’t mean “sell the U.S.”; it means being intentional about global exposures: Japan reforms, selective Europe, and parts of emerging markets where inflation dynamics are more stable and policy credibility is improving are all areas many global-research houses continue to cover closely going into 2026. If global growth stays moderate, relative valuations, sector mix, and currency hedging decisions can matter more than broad market beta.